who do i call about a state tax levy

Wage Levy for Individuals. Omni Tax Solutions is here to help.

How Do State And Local Individual Income Taxes Work Tax Policy Center

A levy against currently held contract payments and future payments to an individual or entity that has assessments andor tax liens due to the SCDOR.

. If you have a tax debt the IRS can issue a levy which is a legal seizure of your property or assets. The State Income Tax Levy Program SITLP is an automated levy program administered by the IRS that uses state tax refunds as the levy source. Resolving your federal tax liabilities with your citymunicipal tax refund through the.

Tax levies can collect funds in several different ways including taking funds. Tax levies are collection methods used by the IRS where they can legally seize your assets to cover back taxes. If you receive an IRS bill titled Final Notice Notice of Intent to Levy and Your Right to A Hearing contact the IRS right away.

One of the most common questions taxpayers have is who do I call about a tax levy It doesnt matter what type of tax levy you are dealing with. Call us today for a free consultation and to get more information about state tax problems and tax. A tax levy is a legal seizure of your property by the IRS or state taxation authorities.

Levies are different from liens. You dont have to face your state tax levy problem alone. What is a Levy.

It can garnish wages take money in your bank or other financial account seize and sell your vehicle s real. To receive assistance by phone please call 1 800 732-8866 or 217 782-3336. How do I contact the IRS about a levy.

If you receive an IRS bill titled Final Notice Notice of Intent to Levy and Your Right to A Hearing contact the IRS right away. Our TDD telecommunication device for the. All amounts should be rounded to the nearest dollar.

A property tax levy is the right to seize an asset as a substitute for. The state and IRS notices refer you to call 800 829-7650 or 800 829-3903 for assistance. Complete and return the Payable 2023 Property Tax Levy Report by December 30 2022 to.

A tax levy is a procedure that the IRS and local governments use to collect money that you owe. The time it takes to resolve a. The IRS or State can levy your property if you have delinquent taxes owed and dont take action to resolve.

2 hours agoMiami Valley Fire District which has covered both communities for the past decade had total revenue of nearly 101 million in 2021 against expenses of 102 million. A tax levy is a legal seizure of your property by the IRS or state taxation authorities. A lien is a legal claim against property to secure payment of the tax debt while a.

18 hours agoSome panel members on the Pre-Budget Forum organised by Joy Business have called for a massive reduction in the electronic transfer levy to encourage Ghanaians to. Representatives are available Monday through Friday 8 am - 5 pm. All amounts up to the total amount due to.

The Minnesota Department of Revenue may issue a wage levy to collect tax debt or debt we collect for another agency. For more information you may call the. The state and IRS notices refer you to call 800 829-7650 or 800 829-3903 for.

A levy is a legal seizure of your property to satisfy a tax debt. When we send a wage levy notice to. An IRS levy permits the legal seizure of your property to satisfy a tax debt.

An IRS tax levy is a legal seizure of your property to compensate for your tax. A tax levy under United States federal law is an administrative action by the Internal Revenue Service IRS under statutory authority generally without going to court to seize property to. For the status of your state tax.

How do I contact the IRS about a levy. It is different from a lien while a lien makes a claim to your assets as.

Irs State Tax Levy Guide How They Work How To Stop Help

Irs Letter 2975 Intent To Terminate Installment Agreement H R Block

Common Irs Notices To Know A Taxpayers Guide Rush Tax

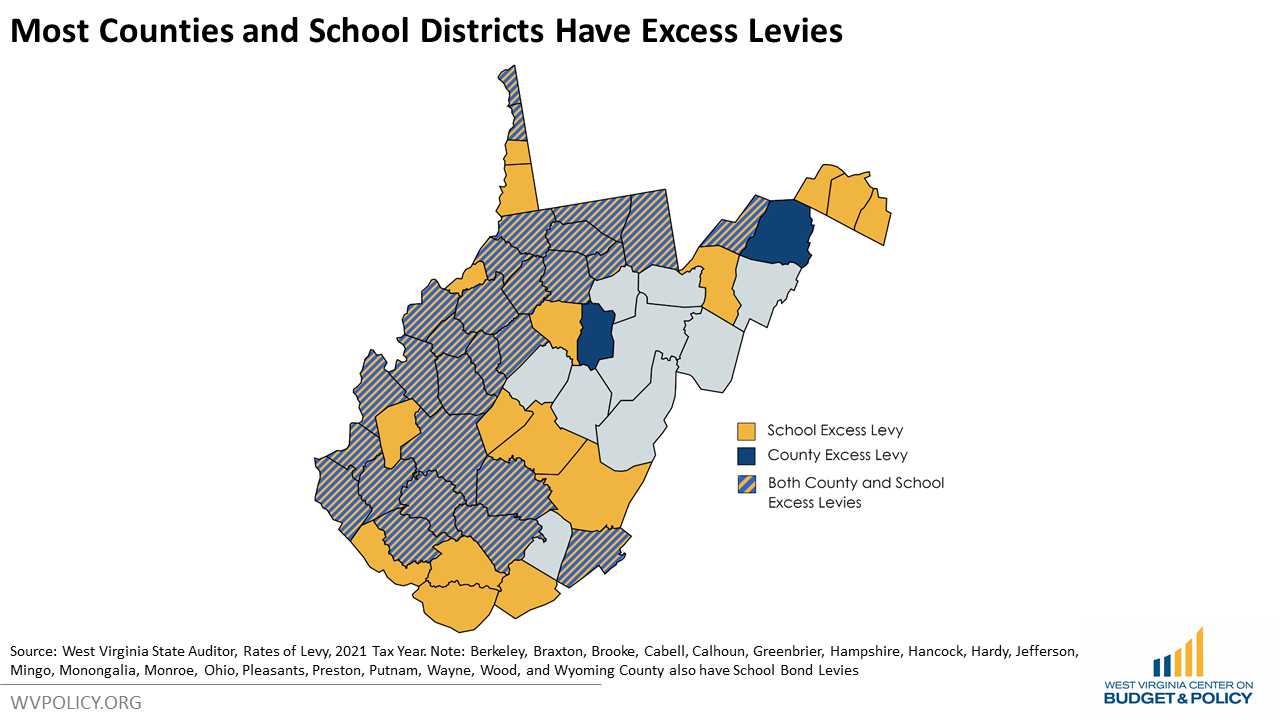

Proposed Property Tax Amendment Could Jeopardize Local Excess And Bond Levies West Virginia Center On Budget Policy

State Bank Levy How To Where To Get Help With Bank Levies

Tax Levy Understanding The Tax Levy A 15 Minute Guide

What Is A State Tax Levy State Income Tax Levy Program

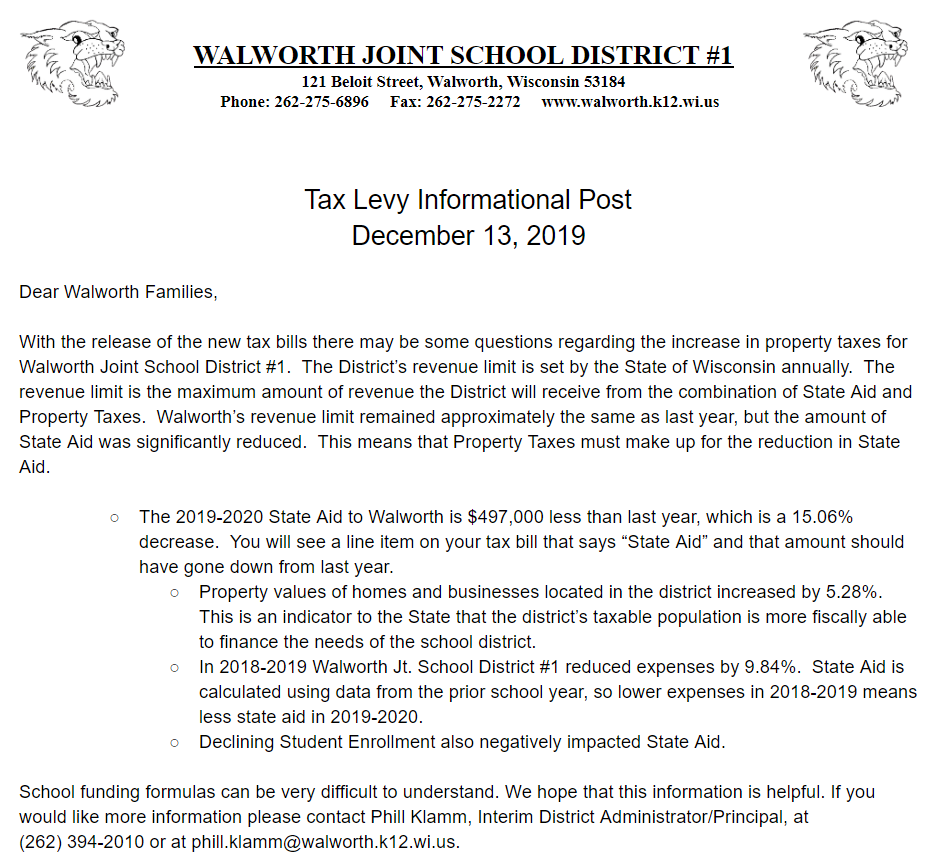

Tax Levy Information Walworth Jt School District 1

The Tax Levy Limit When Is 2 Not Really 2

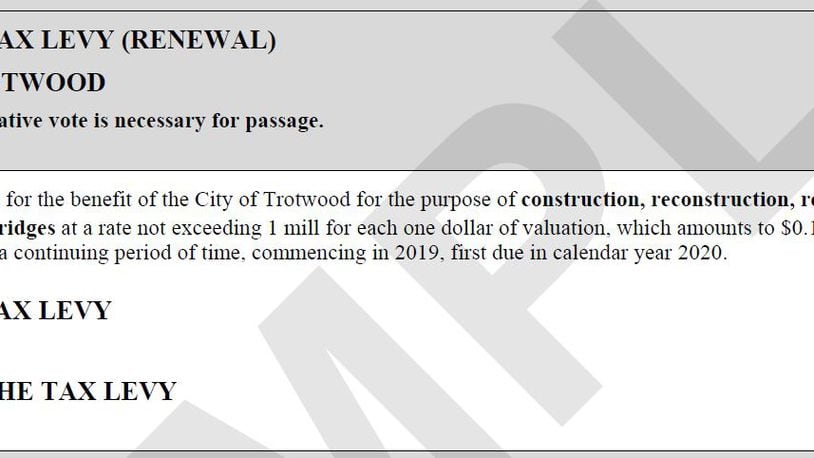

Ohio Bill Targets Property Tax Levy Language Changes Education Groups Among Opponents Police Fire Roads Politics Education Jobs Economy Real Estate Mike Dewine

Who Do I Call About An Irs Tax Levy

What Is A State Tax Levy State Income Tax Levy Program

Orange City S Total Property Tax Levy Rate Ranks 551st In The State Orange City

Tax Levy Understanding The Tax Levy A 15 Minute Guide

Bloomington Area Budget Prep Income Tax Revenues For 2023 Projected Up 13 Property Tax Levy Up 5 The B Square

Scam Relies On Fake Letters About State Tax Debt Officials Warn Mlive Com